The K-Shaped Recovery and Publishing

Winners will get bigger, while smaller players prepare for steep declines

It begins with higher education. By hitching the biggest revenue wagon to institutional site licenses a couple of decades ago and shunning individual subscribers for the most part, scholarly publishers created a dependency that seemed at the time — like real estate pre-2008 — immune to collapse. After all, university degrees were becoming requirements for social mobility, tuitions were rising, administrators were being hired, the marketing of college was embedded in US high school cultures and curricula, and colleges were flourishing.

Like the collateralized debt obligations (CDOs) of 2008, which infected the economy with hidden particles of default and instability, the Covid-19 epidemic in the United States portends to do the same to universities and the scholarly economy as a whole.

But unlike the 2008 crash, some major winners will emerge from the Covid-19 economic upheaval. Some have already emerged, and are headed up the arm of the “K.” Apple has added $1 trillion (with a “t”) to its valuation in a few short months, an amount it required decades to achieve the first time. Amazon is on its way to doing the same, having crossed the $1 trillion valuation line in January and with a stock that could complete its jump to another $1 trillion before the holiday shopping season concludes.

In our world, the winners aren’t readily apparent. Springer Nature was hoping to jump on the arm of the “K” with a renewed push for an IPO, which fizzled again. John Wiley & Sons is apparently seeing some worrisome trends, and its stock is down ~34% from its pre-pandemic high, while Elsevier’s stock is down ~20% over an equivalent period. Informa’s stock is down ~50% since earlier this year. Rumors of non-profits laying off staff are starting to percolate.

But there are some potential winners. Wolters-Kluwer stock is up 10% since before the pandemic settled in, likely due to its legal and medical lines of business, as well as its efficiency with capital allocation, which allows the company to deliver consistent and high dividends to investors.

Meanwhile, universities have started to see the more worrisome leg of the “K” as drops in enrollment hit much of the country. In New England, where I live, two dozen colleges saw their Fall enrollments drop more than 20%, and another 50 colleges and universities saw their enrollments drop 10-20%. Across the country, enrollments are down 4% overall.

The “stop and think” moments created by the pandemic — where financial uncertainty, social uncertainty, and political uncertainty have caused us all to reconsider things we once took for granted — have also seen parents and students actively interrogate the value proposition of college. It’s coming up short for some, apparently. New certification options and other competitive educational initiatives are using the moment to insert themselves. And tech employers in particular are probably willing and able to take a promising high school student and train them to do the work they need done — work that pays well, can be done from home, and will provide stability for years to come.

For universities facing financial challenges, splashy infrastructure and amenities developed during the boom times look like prime targets for cuts. In conversations with parents with students in college, the beautiful campuses, excellent dorms, and stellar food services at most universities now are conveying a different image than in the past — one of excess and indulgence, of expenses that can be trimmed.

The number of advisors and administrators is also inspiring ideas of budget cuts. Stories of administrative bloat and excessive spending are not hard to find. In 2017, the University of California was found to have “used misleading budgeting practices, provided its employees with generous salaries and atypical benefits, and failed to satisfactorily justify its spending on systemwide initiatives.” Worse, the Office of the President “was unable to provide a complete listing of the systemwide initiatives, their costs, or an assessment of their continued benefit to the university.” Add to this the salaries for coaches, the fees for various amenities, and the college admissions sytems and its burdens, and you can see parents sizing up where they’ll be using a scalpel — or a machete — to bring costs down from high school forward.

Another clear target for budget cuts is the library, which seems even more outmoded as a concept when everything is virtual. To be realistic, I think libraries can expect to see big budget cuts coming soon. This will affect subscription and APC budgets, perhaps in a compounded fashion, as libraries redirect some budget to protect staff.

For publishers, the threats to the Big Deal may not mean much to their profitability, because what it may trigger — as smaller, less-read journals are picked off — is simply an exercise in managing expenses, as some potentially important journals in smaller fields cease publication.

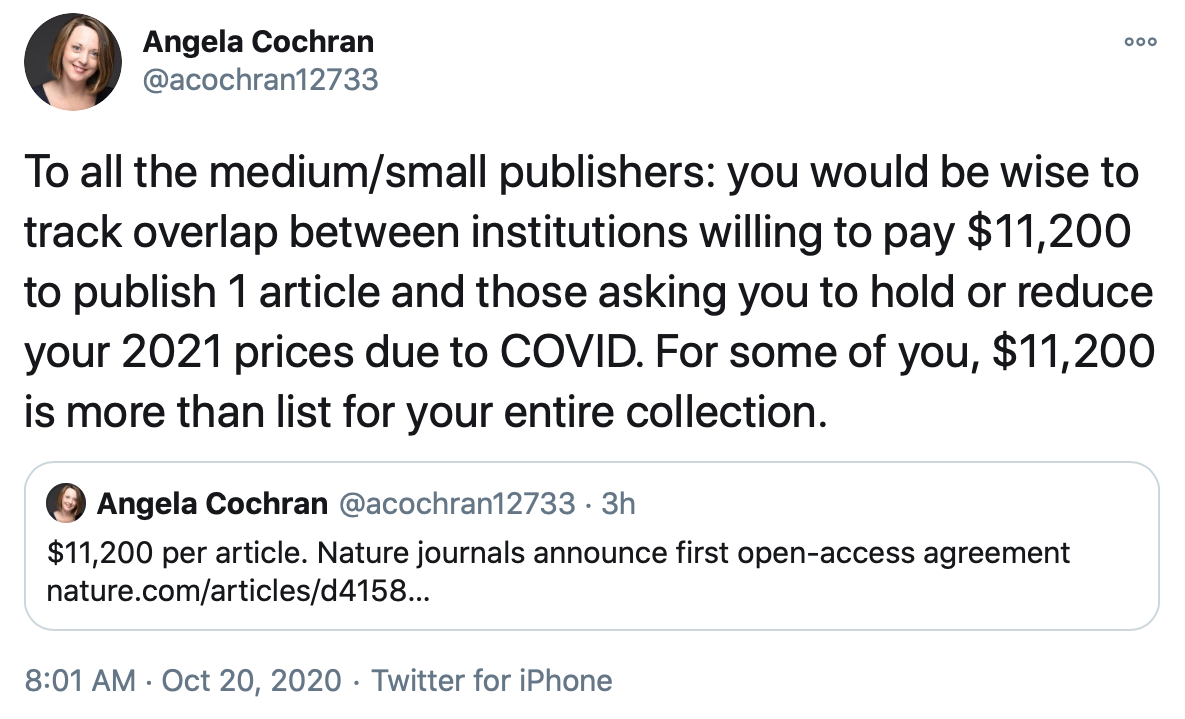

An interesting wrinkle is Nature’s announcement today of a deal with Plan S funders to allow publication of some articles for an $11,200 APC. As Angela Cochran noted on Twitter:

This brings to mind the recent “CAP Model” proffered by PLOS, which faces some challenges, the most significant of which is timing — asking institutions for more money in the face of falling enrollments, revenue shortfalls, and likely imminent staffing cuts is not likely to succeed. The same goes for Nature’s OA plan.

And so the fight for money escalates.

Smaller institutions are poised to suffer more than larger, richer, academically diverse, and better-known institutions. But even the larger institutions will tighten their belts, with significant implications for staffing, library budgets, and overall expenditures.

Smaller publishers and niche journals — whether selling directly or as part of Big Deals with commercial publishers — will also be threatened, as Big Deals are picked apart, renewal budgets are gutted, and/or library administrators redirect funds to protect staff positions.

This all shines a light on the lack of revenue diversity among publishers. Even new initatives like Nature’s and PLOS’ are going after institutional budgets. It may be time to throw a revenue option out — individual subscriptions, new products — to leap from the leg of the “K” to the upward facing arm.

A good crisis is a terrible thing to waste. Managing expenses is not the only way forward. It may also be a good time to catch everyone else off-balance and make a move to diversify revenues and product portfolios.

After all, the intriguing thing about a “K” recovery is that for the proactive and creative, there can be an upside.